THE CRISIS OF SEMICONDUCTORS AND ITS LONG-LASTING CONSEQUENCES

The demand for such a large number of semiconductors has grown over the years as the world becomes increasingly digital, with processor chips used in everything from smartphones to cars and washing machines.

When analyzing the issue of the global semiconductor crisis, it is worth noting the prerequisites that caused this situation in the IT market. And the prerequisites for the crisis arose in 2018 when the trade war between the United States and China began. Sanctions were also imposed on many Chinese companies that produced semiconductors. The United States gradually began to move towards a deficit. During the COVID-19 pandemic, the situation only worsened as the demand for electrical equipment increased significantly. The reason for this was remote work and education, quarantines during which people are at home, and the need for medical institutions for diagnostic equipment.

The crisis has a major impact on global giants. Sony shares, for example, have fallen by about 13% since the beginning of fiscal 2021, which ends in March; the company's value has decreased by $25.71 billion. The main reason is that the Japanese giant has reduced its sales plan for PS5 gaming consoles for the whole year from 14.8 million to 11.5 million units. The reason was the lack of chips. Moreover, due to the shortage of semiconductor components, Tesla allegedly decided to remove one of the two electronic control units that are usually installed on the steering rods of some Model 3 and Model Y. Other auto companies were also forced to close many factories due to a shortage of chips in production.

It is now quite obvious that most global companies will need new production capacities to get out of the crisis. For example, Intel is investing heavily in the construction of semiconductor factories in the US and Europe. Now Intel is stopping the supply of the latest developments to China.

The world-famous American corporation "Apple" is moving its factories from China to India. What is important is that the company's management said that Apple will purchase chips from American manufacturers.

It should be understood that increasing the production capacity of microcircuits is a long-term and complex process. Resolving the semiconductor crisis presents challenges requiring comprehensive strategies and collaborative efforts among industry leaders, government agencies, and the international community. One key component of a successful strategy is to stimulate research and development of new semiconductor technologies. Investments in research, education, and innovation programs can lead to discovering new materials and manufacturing technologies that will improve the efficiency and sustainability of semiconductor devices.

THE BEGINNING OF THE CRISIS

As is often the case, the current semiconductor crisis is not a one-off problem that came out of nowhere but the result of several overlapping crises that have characterized the early 2020s. These include the structure of the industry itself, the limited capacity available to meet the global surge in demand for semiconductor chips, and rising protectionism and geopolitical instability.

What is unlikely to change anytime soon is a fundamental characteristic of the semiconductor industry itself. Manufacturing semiconductor chips is not only extremely capital-intensive but also a labor-intensive process, consisting of hundreds of individual steps. First, 99.99 percent pure single-crystal silicon ingots (cylindrical rods) must be manufactured, cut into wafers, and polished. They are then coated with photoresist and exposed to extreme ultraviolet light (in what’s known as lithography, ultraviolet light hits the photoresist, causing a chemical change). In the next step, the wafers are cleaned, doped, and etched multiple times to create the intended pattern. The complexity of this manufacturing process is further illustrated by the positive or negative photoresists, wet or dry etching, the wide range of silicon dopants available, and the fact that these processes must be repeated countless times. Finally, the wafers are ionized. Once all of these steps are complete (which can take up to three months), the wafers are cut into individual chips, inserted into a protective carrier, and glued together (called “packaging”).

This final step in manufacturing is extremely labor-intensive, meaning the COVID-19 lockdowns have had a major impact on this stage of the manufacturing process. Such complex, multi-step manufacturing processes are challenging at the best of times but are nearly impossible to maintain during lockdowns and supply chain disruptions. Moreover, the semiconductor industry is highly capital-intensive (depending on the wafer size). Building a semiconductor fab can cost well over US$10 billion. Consequently, in economically unstable times, manufacturers are hesitant to expand capacity beyond the bare minimum, not least given the long-term implications of doing so—building a fab is a long-term investment and takes around 3–4 years to ramp up. Manufacturers’ reluctance was further reinforced when the auto industry canceled all orders at the start of the COVID-19 crisis to optimize its inventory levels. Factories are not profitable at capacity utilization rates below 85 percent, meaning that a fab needs to be operating at near-optimal capacity utilization for it to be economically viable.

When car sales recovered faster than expected in 2020 and remote working and homeschooling increased demand for laptops, demand for chips suddenly surged. A perfect semiconductor storm emerged when China began stockpiling chips 1 in response to ever-increasing trade tensions, and the industry's limited capacity was unable to meet the explosive demand.

INDUSTRIES THAT WERE MOST AFFECTED BY THE CRISIS

Several industries rely heavily on semiconductor chips to operate, but the current shortage of these chips has caused a major disruption to the global supply chain. As a result, companies are struggling with increased costs and production delays. This ultimately translates into lower profits and higher prices for consumers. Three specific industries are expected to lead over 68% of the growth in the semiconductor industry. The automotive sector is poised to be the main driver, followed by storage technology and wireless technology.

Automotive Sector: The automotive industry has been hit hard by the shortage, leading to production shutdowns and delays. This pandemic-induced shortage has led to a 25% decline in global auto sales in 2021. Additionally, there has been a significant decline in auto sales across the globe, with Europe down 81%, China down nearly 69%, and the US down 51%. Automobile manufacturers have faced difficulties in obtaining the required semiconductor chips for critical functions such as infotainment systems, advanced driver assistance systems (ADAS), automotive electronic control units (ECUs), and other automotive cockpit electronics.

Several industries rely heavily on semiconductor chips to operate, but the current shortage of these chips has caused a major disruption to the global supply chain. As a result, companies are struggling with increased costs and production delays. This ultimately translates into lower profits and higher prices for consumers. Three specific industries are expected to lead over 68% of the growth in the semiconductor industry. The automotive sector is poised to be the main driver, followed by storage technology and wireless technology.

Automotive Sector: The automotive industry has been hit hard by the shortage, leading to production shutdowns and delays. This pandemic-induced shortage has led to a 25% decline in global auto sales in 2021. Additionally, there has been a significant decline in auto sales across the globe, with Europe down 81%, China down nearly 69%, and the US down 51%. Automobile manufacturers have faced difficulties in obtaining the required semiconductor chips for critical functions such as infotainment systems, advanced driver assistance systems (ADAS), automotive electronic control units (ECUs), and other automotive cockpit electronics.

ALTERNATIVES AND SOLUTIONS TO COPE WITH THE SEMICONDUCTOR SHORTAGE

American semiconductor giant Intel is planning to build a chip factory in Europe. The city where the project will take place will be announced very soon (although the favorite at the moment seems to be Dresden in Germany).

Intel wants to build two manufacturing units worth 10 billion euros and employ 1,500 people each. This will allow European players to buy directly from Europe and thus use Asian companies less often.

Renault x Qualcomm Alliance: American chipmaker Qualcomm has signed an agreement with Renault to expand their semiconductor partnership. Qualcomm technologies will be used in Renault’s future, more connected and intelligent cars.

“Working closely with a technology leader like Qualcomm Technologies allows us to innovate faster to keep up with new trends and meet the needs for complex functionality,” said Thierry Kammal, vice president of the Alliance Software Factory at Renault. TSMC and Sony partnership: The Japanese government has announced its intention to invest almost $400 billion in the construction of a new plant in southwestern Japan. It will be built by TSMC, a Taiwanese company and a leader in the semiconductor market. At the same time, the company also confirmed its intention to invest almost $7 billion in the construction of this plant together with Sony. It is expected to open in 2024. Ford x GlobalFoundries to join forces: Ford recently announced its intention to explore various semiconductor manufacturing opportunities to support the development of the automotive industry. The carmaker will join forces with the American company GlobalFoundries, one of the largest independent semiconductor foundries in the world. The goal is also to increase the supply of chips for Ford, as well as for the American auto market.

SECTOR PROSPECTS AND PLANS FOR FURTHER DEVELOPMENT

Semiconductor makers are at risk of oversupply in the future as most players in the sector have ramped up production and invested heavily in capacity expansion.

Investment bank JP Morgan said the cyclical nature of the chip industry means there will be a period of oversupply at some point in the future.

Asset management firm PIMCO highlighted the risk of China-US tensions for the critical sector, adding that China’s path to self-sufficiency in the semiconductor industry is a “medium- to long-term risk that could fundamentally change the competitive landscape.”

As for the ongoing shortage, the question remains whether the semiconductor shortage is getting worse. Analysts at ANZ Research said semiconductor supply chain constraints are likely to remain tight in 2022 despite signs of easing. Despite the ongoing crisis, the global semiconductor market is projected to grow from $452.25 billion in 2021 to $803.15 billion in 2028 at a CAGR of 8.6%, according to a report by Fortune Business Insights.

While rising demand for semiconductors from various industries can drive the prices of numerous stocks, you should do your due diligence before making an investment decision.

It is important to do your own research and consider the latest market trends and industry news. Always remember that your trading decision depends on your risk tolerance, your experience in the market, the spread of your investment portfolio, and how comfortable you are with losing money. And you should never invest more than you can afford to lose.

CONCLUSION

In the context of the global semiconductor shortage, there is a significant opportunity for countries like India, China, and Taiwan to make a positive impact. India, in particular, is taking strategic steps to establish a strong presence in the global semiconductor market. To further support the chip manufacturing industry and attract investment from the private sector, the government has introduced incentives. Notably, in December 2021, India announced a significant stimulus plan worth US$10 billion to establish itself as a leading global chip manufacturing hub. Currently, India’s semiconductor market, which relies heavily on chip imports, is projected to cross US$99 billion by 2025, up from its current value of US$25 billion. To boost the electronic components and semiconductor manufacturing landscape, India has initiated the Semiconductor Components and Electronics Promotion Scheme (SPECS).

Additionally, Taiwan and South Korea hold a dominant position when it comes to advanced sub-10 nm semiconductor manufacturing capacity, together accounting for around 93%. In terms of overall industry capacity, East Asia and China make a significant contribution, accounting for around 76%. In conclusion, the semiconductor chip shortage is a multifaceted issue that has had a wide impact on various industries. Industries such as automotive, consumer electronics, and healthcare have faced significant challenges as production delays and increased costs have impacted their bottom lines. However, these challenging circumstances have also provided opportunities for innovation and investment in alternative technologies and supply chain optimization. Addressing this issue and finding solutions requires immediate action. Governments, companies, and individuals must come together to collaborate on this issue. By doing so, companies can ensure a more sustainable and stable future for these industries, as well as the global economy.

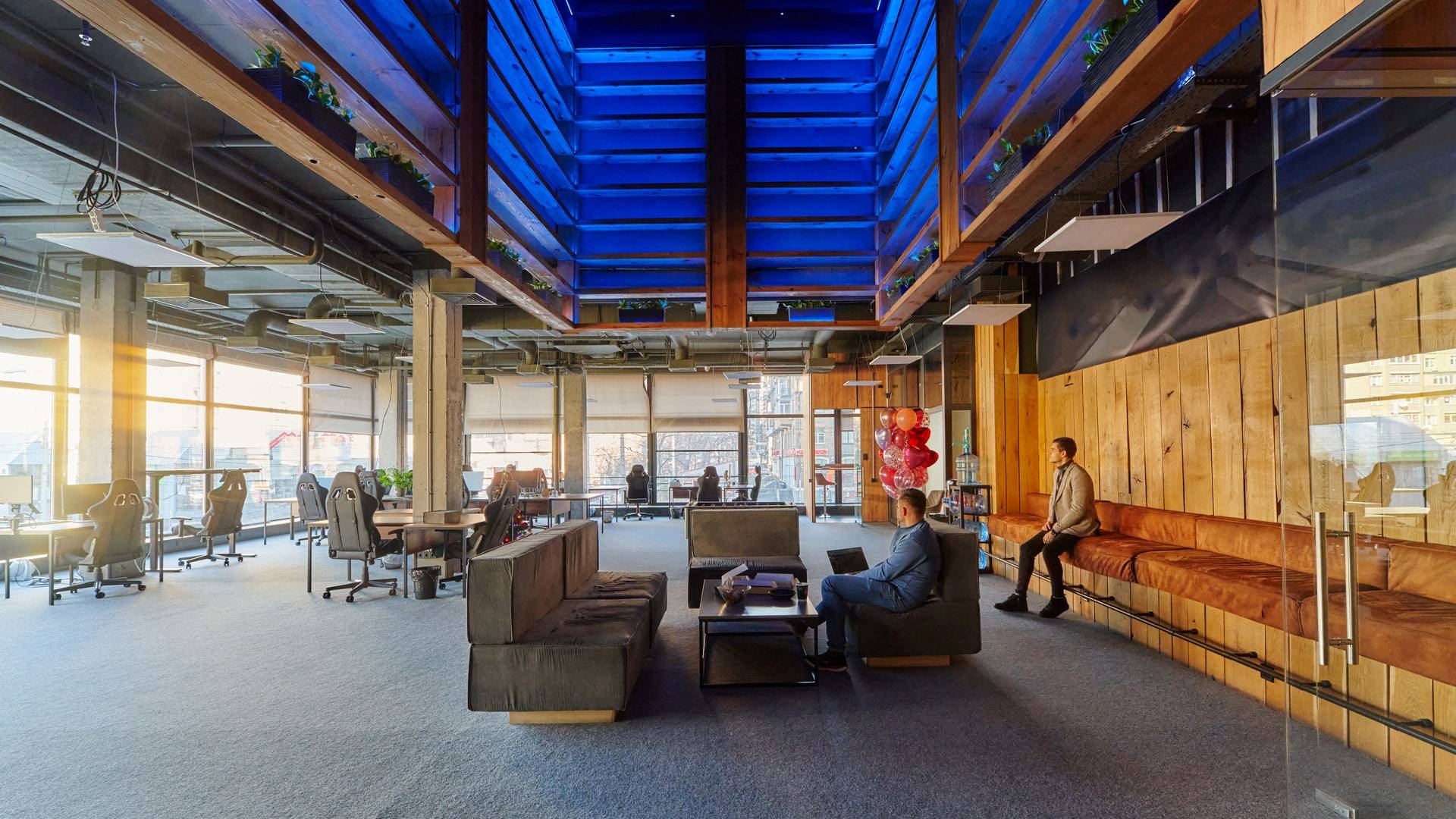

If you have any questions or have an idea about hiring a team of professional developers in Ukraine, we would be glad to fuel your business idea with our services: contact.us@gointeractive.co